[ad_1]

Tether is a blockchain-based cryptocurrency, a stablecoin backed by the US dollar. Bitcoin and most cryptocurrencies typically fluctuate in value based on market supply and demand, while USDT tokens are always worth one USD by design. So, Tether is an excellent option to avoid the risks involved in investing in the stock market.

Tether company claims to hold assets equal to the total outstanding market value of its currency. In other words, it has a dollar in cash or other assets for every one USDT in circulation.

Read on to learn everything you need to know about the Tether platform, the Tether token, and buying Tether.

Let’s dive in!

History of USDT (Tether)

We can trace the history of USDT back to the publication of a whitepaper in January 2012. J.R Willett outlined scenarios involving the hosting of new coins on Bitcoin’s Protocol and Blockchain.

He implemented this idea in the creation of a new protocol called Mastercoin. Subsequently, this new protocol came to constitute the technical foundation of Tether. In fact, one of the founders of the new protocol, Brock Pierce, later co-founded Tether.

Tether started with a precursor token known as Realcoin. Brock Pierce, Craig Sellars, and Reeve Collins successfully launched the new token in July 2014 on the Bitcoin Blockchain.

Realcoin could function on Bitcoin’s protocol using the Omni Layer Protocol. Subsequently, in November 2014, one of the co-founders, Reeve Collins, announced that the coin had been renamed Tether.

In addition, Tether announced that the project would enter a beta stage. The company would test three fiat currencies and Tether (the dollar, euro, and yen) to this effect. This way, the crypto would be supported entirely by its respective fiat currency without any exchange risk.

In January 2015, Bitfinex added Tether to its list of supported digital currencies for trading. It has since been confirmed that Tether and the cryptocurrency exchange platform Bitfinex have the same ownership.

Between January 2017 and September 2018, the circulating supply of Tether grew from around $10 million to about $3 billion. In this remarkable period of growth, Tether accounted for close to 10% of Bitcoins trading volume, and this figure was as high as 80% in the middle of 2018.

On the 15th of October, 2018, the price of Tether suffered a severe crash, at $0.88 because of a speculated credit risk. This was because the Bitfinex platform hosted several sales as traders exchanged USDT for BTC. Subsequently, the price of Bitcoin rose dramatically. There have been allegations that Tether is being used to manipulate the market value of Bitcoin.

As of May 2021, Tether’s adjusted on-chain volume surpassed the $1 trillion mark on a yearly basis. That figure reflects all value transfers within a blockchain network.

How Does Tether Work

Tether is a stable coin, pegged to a fiat currency, in this case, the U.S. dollar (hence the acronym USDT). It was created to bridge the gap between fiat currencies and crypto assets while offering transparency, stability, and low fees for USDT users.

The network issues its token on Bitcoin using the Liquid and Omni Protocols. In addition, it issued tokens on OMG, SLP, Algorand, Tron, EOS, and Ethereum blockchains. Once a Tether (a single unit of USDT) has been issued, it can be used the same as any other currency or token on the chain.

Because of the unique nature of Tether, it’s pegged to multiple fiat currencies. As such, it operates on different protocols, depending on the blockchain on which the particular token is issued.

USDT is an Ethereum-based (ERC-20) token.

Tether uses Proof Of Reserves, which means that at any time, their reserves will be equal to or greater than the number of Tether in circulation. This can be verified via their website.

Why Was Tether (USDT) Created

The founders of Tether pursued three primary goals. The first was to facilitate real-life currency transfers nationwide. The second goal was to provide a cryptocurrency that was not as wildly volatile as Bitcoin. The third reason was to serve as an alternative checking option.

The blockchain can confirm the total amount of USDT in circulation. This figure is then compared to the dollar holdings of Tether Limited, and these two figures must be equal at all times.

There is a need for external audits to check transfer reports, withdrawals, deposits, and balances to this effect.

How to Buy Tether

The steps required to buy USDT are highlighted below:

Step #1: Create an Account With a Crypto Broker

As an investor looking to buy USDT, you first need to open an account on a trusted global exchange like Kraken, constantly rated one of the most secure and trusted crypto exchanges in the world. The exchange you choose must allow you to buy Tether or any other cryptocurrencies you wish. In other words, the broker must offer you market access to Tether.

A cryptocurrency broker is similar to a stockbroker, enabling you to trade whatever stock (in this case, coins) you wish.

Here are some factors to consider when choosing a cryptocurrency broker:

Trading Platform

To enjoy a great trading experience, you should register with an exchange with simple trading tools and a user-friendly interface. More experienced traders should go for platforms that have advanced trading tools like complex charts, etc.

Asset Access

While several cryptocurrency exchanges allow buying USDT, you’d do well to research the platform you’re registering with to see if it supports your favorite trading pairs.

Commissions and Fees

Before registering with a broker to buy crypto, you’d do well to learn about the commissions and transaction fees involved. Many platforms charge you a premium fee for trading; others charge high fees when buying USDT with a credit or debit card. Ensure to conduct due research to avoid losing the bulk of your earnings to hidden charges and steep fees.

Step #2: Acquire a Wallet

After creating an account on a cryptocurrency exchange platform, the next step will be to choose a cryptocurrency wallet. Crypto wallets safely store your private keys, keeping your funds safe and accessible. They also allow you to transfer, receive and spend cryptocurrencies easily.

Your private key is a critical piece of information used to authorize outgoing transactions on the blockchain network. When you make transactions on the blockchain, you share your public keys, not your private keys. Sharing your private keys can compromise the safety of your hard-earned tokens.

There are two types of eWallet:

Hot Storage: Keys are stored in an app or other software. This makes sending, receiving, and using your crypto as easy as using an online bank account, payment system, or brokerage.

Cold Storage: A cold wallet is much more secure than a hot wallet. Cold wallets are physical devices that safely store your keys offline. Hardware wallets like Ledger Nano S or Ledger Nano X are the most secure ways to store your coins. Ledger gives you full control over your crypto and lets you access all key services securely.

Step #3: Buy Tether (USDT)

The next step is to place an order to buy Tether.

Choose a payment method for buying USDT. You can buy it with fiat money via bank transfer, credit, or debit card or trade with other crypto assets. Beware of hidden charges.

Some exchanges offer an Instant Buy/Sell function that allows you to buy Tether directly in less than a few minutes without involving third parties and additional payment services.

You can also choose among the different order options described below:

Market Orders: If you place a market order, you inform the brokerage of the specific number of coins you would like to purchase. Market orders execute a trade immediately at the best available price.

With a market order, you cannot fix your purchase price; instead, you buy cryptocurrencies automatically at the current USDT price. Market orders are more popular than other forms of trading.

Limit Orders: A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower. For instance, you can place a limit order to buy 500 USDT at $2. If the price of each token does not go above $2, your order will be filled.

How to Buy USDT Using Coinstats

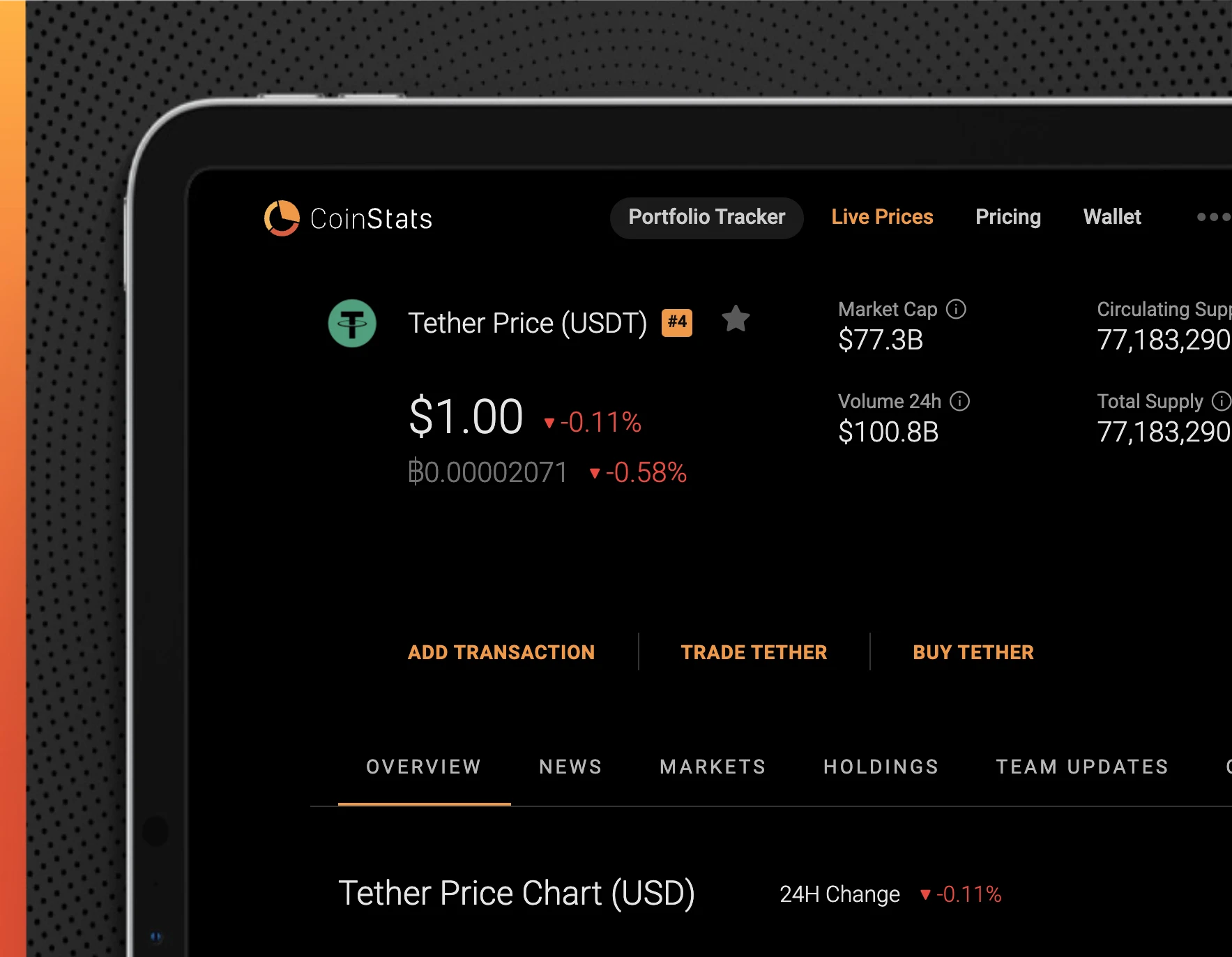

CoinStats is one of the best ways to buy USDT.

In addition, you can check token prices such as PancakeSwap price, learn about the circulating supply, and several key stats about hundreds of cryptocurrency tokens.

All you need to do is to create a CoinStats account. Search for USDT and click on Trade USDT. Note that you cannot directly buy Tether on CoinStats. However, the platform has integrations with sites like Binance, where you can directly purchase the tokens.

Why You Should Buy Tether

The main reason to buy Tether is that it’s a stable coin that’s not susceptible to volatility compared to other cryptocurrencies like Ethereum and Bitcoin. For additional information, you can visit the official website of the Tether platform.

Conclusion

The USDT token currently ranks 4th by market cap in the crypto market.

It doesn’t suffer from the extreme volatility of Bitcoin and other altcoins, making it a suitable choice for investment. Buying USDT is also quite easy, as many platforms support it. If you own USDT, make sure to track it in real-time along with all your other crypto and DeFi assets on CoinStats.

We hope you enjoyed reading our article and found the information we’ve provided helpful. You might also enjoy other articles on cryptocurrencies and blockchain technology regularly posted on our blog. Check them out!

[ad_2]

Source link