[ad_1]

By Rebecca Barnatt-Smith

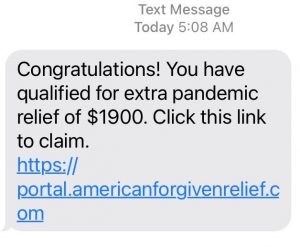

A recent survey conducted by Intertrust has indicated that hedge funds will increase their cryptocurrency holding to 7% in the next five years. Moreover, by 2026, hedge funds plan to increase their crypto exposure significantly, producing new digital assets and currency confidence.

The increasing involvement of prominent figures and names in the hedge funding world has led to this outlook. For example, a survey of 100 hedge fund chief financial officers worldwide expects that, on average, 7.2% of their assets will be held in cryptocurrencies in the next five years. Most of whom expect to see their assets exceed by a generous 10%.

(Image Source: Bitcoin News)

If this is to be the case in five years, and this figure is copied across to the entire hedge fund industry, the total amount of assets invested in crypto in five years could be shy of $312 billion.

If this happens and expectations are exceeded, then there will be a significant increase in the collection of crypto held worldwide, making it a prominent feature in the financial industry. Although $312 billion only scratches the surface of Bitcoin's (CRYPTO: BTC) market capitalization today, it paints a vivid picture of the future.

However, some analysts argue that purchasing digital assets remain at large still quite limited to clients, especially for those who have a high-risk tolerance. Even with this in mind, investments …

Full story available on Benzinga.com

[ad_2]

Source link