[ad_1]

Tezos (XTZ) is an open-source, self-upgradable blockchain platform for creating and hosting DApps. The platform’s native digital token is XTZ. Tezos allows anyone who owns its XTZ token to vote on any future changes to network rules, including changes to the governing process.

Check the Tezos current price, market cap, circulating supply, trading volume, historical statistics, etc., on CoinStats, one of the best crypto platforms around.

Read on to learn everything you need to know about the Tezos platform, its native token XTZ and learn how to buy Tezos in a few simple steps.

Let’s jump right in!

Pros

- Proof of Stake: Tezos utilizes the energy-efficient and inexpensive PoS consensus mechanism.

- Staking Opportunities: XTZ owners can stake their coins to gain profit and participate in community decisions.

- High Safety Level: Tezos aims to provide the safety and code correctness required for assets and other high-value use cases.

- Self-amendment: The Tezos blockchain possesses a modular architecture and formal upgrade mechanism, meaning it can smoothly propose and adopt new technological innovations.

Cons

- Low Popularity: Tezos lacks commercial support.

- Immature Network: Many developers still consider the network underdeveloped, as it’s difficult to predict its transaction fees and speeds once the platform becomes more widespread.

The CRC ranks Tezos with a score of 3.75/5. However, the CRC has no actual power to classify an asset; instead, this task resides with the Securities and Exchange Commission (SEC). Now, let’s look into the network and see what makes Tezos XTZ unique before learning how to trade Tezos or how to buy Tezos XTZ quickly and easily.

What Is Tezos

Tezos (XTZ) is an amendable blockchain network that incorporates advanced protocols to support the development of decentralized applications (DApps) and the coding of smart contracts. While Tezos offers similar features to other cryptocurrencies, its system of operations has several core differences:

- Self-amendment. While Proof-of-Work platforms need to fork, when introducing changes to the system, protocols that utilize the Proof-of-Stake consensus mechanism, like Tezos, can vote on the proposed upgrade and implement it much faster and easier.

- Staking Opportunities. XTZ holders can participate in the validation mechanism if they own over 8,000 XTZ tokens. They can also delegate their Tezos to a validator to earn interest on the tokens while having a say in the protocol’s governance.

- Network Size. Tezos is much smaller than Ethereum, so the congestion and high gas fee problems that plague Ethereum don’t apply to Tezos. At the time of writing, Tezos’ total value locked (TVL) stood at $87 million instead of Ethereum’s $84 billion (Check also our article on how to buy Ethereum).

Tezos XTZ History

Tezos was founded in 2017 by Arthur and Kathleen Breitman. The Tezos ICO managed to raise $232 million from its initial coin offering (ICO) in just 2 weeks but ran into many management issues shortly after this record-breaking ICO. The company called Tezos Foundation held all the funds and refused to disburse the funds to Tezos co-founders. However, after unwanted media attention and civil lawsuits which had plagued Tezos, things settled, and the project started working as intended.

Tezos currently has a market cap of over $2.6 billion. New tokens on Tezos are minted at an inflation rate of 5.5% annually, a relatively high inflation rate for a cryptocurrency token. The growth of Tezos could be attributed to investors’ newfound attention to smart contracts and the rise of altcoins in 2021.

How to Buy Tezos (XTZ) in 4 Quick Steps

Now that you know how Tezos works and why it’s unique, you can follow our simple step-by-step guide for buying Tezos right away!

The method for purchasing the XTZ token is the same as buying any other cryptocurrency. Additionally, there’s usually a shortage of available XTZ pairs on exchanges, so you might have to purchase another cryptocurrency first and then trade it for XTZ.

Let’s get started.

Step #1: Choose a Crypto Exchange

Several cryptocurrency exchanges allow you to trade XRZ. You’ll have to compare them to choose a trading platform with the features you want, such as low fees, an easy-to-use platform, and 24-hour customer support. Also, consider if the cryptocurrency exchange allows buying Tezos with your preferred payment methods, such as a credit or debit card, another cryptocurrency, or a bank transfer. Some exchanges support advanced trading features and services like a limit order or market orders, crypto loans, and crypto staking that let you earn interest on your crypto holdings.

Cryptocurrency exchanges come down to two main categories: Centralized exchanges (CEXs) and Decentralized cryptocurrency exchanges (DEXs). Each of these categories has pros and cons that traders should consider before registering an account and starting to trade. The degree of the exchange’s decentralization determines how the platform conducts transactions, lists new crypto assets, and deals with customers.

Centralized vs. Decentralized Exchanges

A centralized crypto exchange or CEX is like a traditional exchange but for trading in digital assets. CEXs like Binance, Coinbase, or eToro USA LLC are governed by a centralized system and charge specific fees for using their services. The bulk of crypto trading takes place on centralized exchanges, which allow users to easily convert their fiat currencies like the euro or dollars directly into crypto. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, a CEX holds your digital assets on its platform while trades go through – raising the risk of hackers stealing the assets.

On the other hand, a decentralized exchange (DEX) is not governed by any central authority; instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade in crypto assets without the need for a regulatory authority. They deploy an automated market maker to remove any intermediaries and give complete control over the funds to users. Decentralized exchanges are less user-friendly from an interface standpoint and also in terms of currency conversion. For instance, they don’t always allow users to deposit fiat money in exchange for crypto; users have to either already own crypto or use a centralized exchange to get crypto. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

Exchange Platform Security

Centralized crypto exchanges are easy to regulate as compared to decentralized exchanges. Centralized exchanges are regulated, need licenses to operate, and are compliant with the regulatory authorities. So, it typically takes crypto assets a while to jump through enough hoops to get a CEX listing.

Conversely, DEXs are happy to list new tokens, which could potentially be rug pulls, or fraudulent in any other way. However, DEXs’ peer-to-peer trading makes hacks highly unlikely, as the platform itself doesn’t step in and doesn’t possess any of the funds exchanged. To summarize, CEXs have very strict security procedures, but Decentralized crypto exchanges offer more protection.

Tezos tokens are available on centralized and decentralized platforms, so you can choose any platform that best suits your investment needs and personal preferences. While some users prefer CEXs due to their popularity, speed, and feature, others go for DEXs for their security and zero transaction fees.

We’ll continue with the Binance exchange as an example, parallelled with DEXs to present you with a better picture.

Step #2: Registration

After you’ve decided on a reliable exchange, the next step is to open a trading account to buy or sell Tezos. The requirements differ depending on the platform you pick. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required in most transactions. You must provide this information to be authenticated if you plan to deposit fiat currency from your bank account to purchase the XTZ token.

It’s advisable to enable two-factor authentication (2FA) to keep your funds safe once you’ve verified your identity.

Some decentralized exchanges don’t require a registration process, and you just have to link your existing crypto wallet to the platform and be on your way.

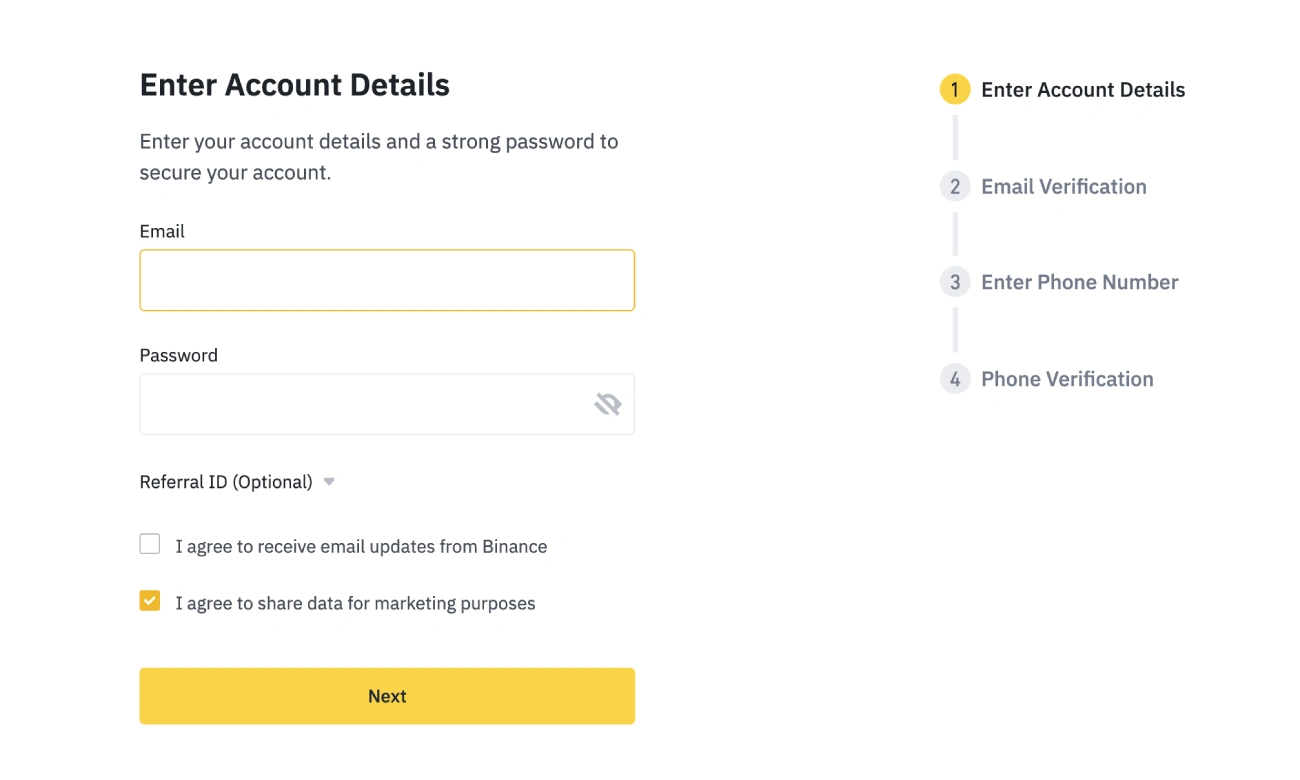

To register on Binance, you need to provide an email or a phone number and come up with a secure password. KYC is not a requirement, but the lack of additional information will limit your trading opportunities on the platform.

Step #3: Fund Your Account

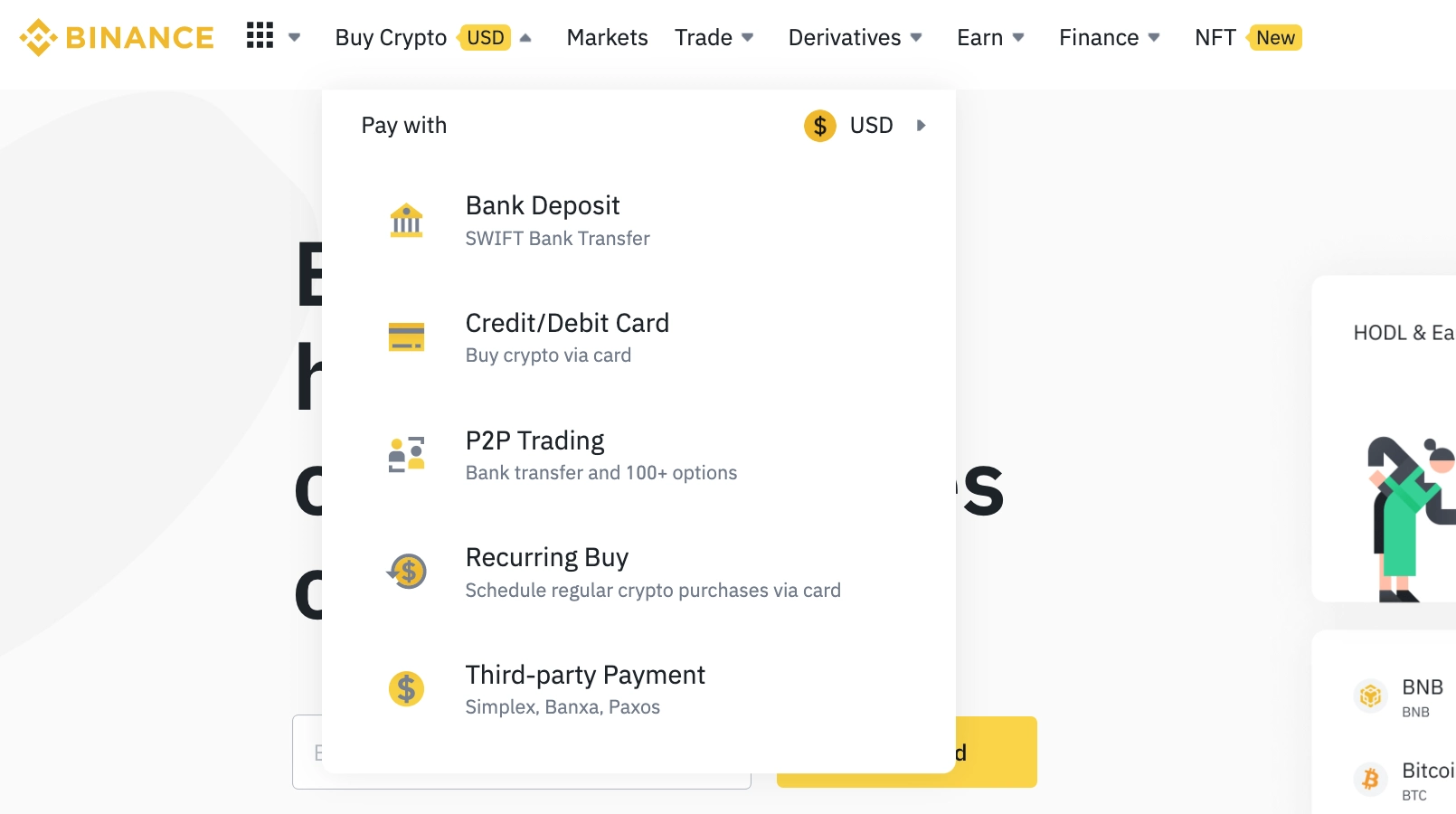

You can deposit funds onto your new account now that you have a cryptocurrency account. Binance offers traders several options, but as there are no direct fiat-Tezos XTZ pairs, you’ll have to purchase other cryptocurrencies first. It’s advisable to first buy major cryptocurrencies, like BTC or USDT stablecoin.

When it comes to buying Bitcoin (BTC) or Bitcoin Cash, Binance provides you with several options – to purchase the coin through a direct wire transfer from your bank account, with your credit or debit card, or with other crypto assets.

Fund Deposit Options

You can link your bank account to your Binance account to make a bank transfer for buying stablecoins listed on the platform and exchange those for BTC. However, consider that not all fiat currencies are supported for the Bitcoin purchase, and USD, EUR, AUD, and GBP are among popular options.

Also, if you are a U.S.-based trader, some exclusions might apply, and a Coinbase account instead of Binance could come in handy. For example, Connecticut, Hawaii, New York, Texas, Vermont, Idaho, and Louisiana residents cannot trade on Binance.

Another option is to buy BTC with a credit or debit card. Linking your debit card to your crypto account is advantageous as it lets you make instant or recurring purchases, but be aware that it attracts an additional fee.

Tezos can be traded for another currency like Ethereum or a stablecoin like Binance USD (BUSD); the trading pairs vary between exchanges, and you will need to search for XTZ on the spot market to select a pair from the list of available currencies.

Now that you’ve chosen a payment method that best suits your needs let’s proceed to the next step and exchange your fresh BTC for some XTZ.

Step #4: Puchase Tezos XTZ

As a proud owner of BTC, you can finally exchange them for XTZ. Choose your trading pair among several options listed on Binance or Coinbase, considering the current price, and trade your BTC or other cryptocurrencies for XTZ.

What to Do With Your Tezos XTZ

When it comes to crypto markets, the landscape changes rapidly. So, even if you plan to store your XTZ for the long haul, you might want to exchange it. Here is a small list of options on how to use your Tezos tokens:

- Keep Your Tezos XTZ in a Safe Wallet: Hardware wallets are the best way to securely store crypto tokens. A hardware wallet offers offline storage, thereby significantly reducing the risks of a hack. Ledger Nano S or Nano X are arguably the most secure hardware wallets that store your public and private keys, letting you securely manage your XTZ tokens.

- Exchange XTZ Tokens. Day trading is big among crypto investors, so don’t worry if you go through a lot of hassle to acquire XTZ and then decide to trade it. All options for trading XTZ are viable.

- Stake Tezos. As Tezos uses the Proof-of-Stake mechanism to validate transactions, you can earn rewards by staking your coins. Remember that the Tezos price is volatile, and staking could be risky, so make sure to track prices on crypto portfolio trackers.

Conclusion

One of the main goals of Tezos is to become a blockchain capable of creating the best reward structure in the world. The XTZ token can be used for holding, sending, spending, or baking, and XTZ token holders can vote on network upgrades.

Tezos is currently used as a staking currency, a speculative investment tool, and a form of payment.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Tezos price is highly volatile, and like other volatile assets, it’s susceptible to fluctuations that can cause loss of funds. Do your independent research and only invest what you can afford to lose. Investments are subject to market risk, performance is unpredictable, and the past performance of Tezos is no guarantee of its future performance.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and take the time to explore all your options before making any investment.

[ad_2]

Source link